Panarisk's

REST API

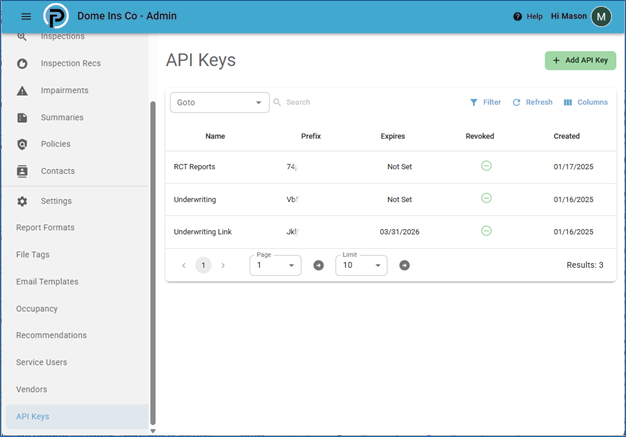

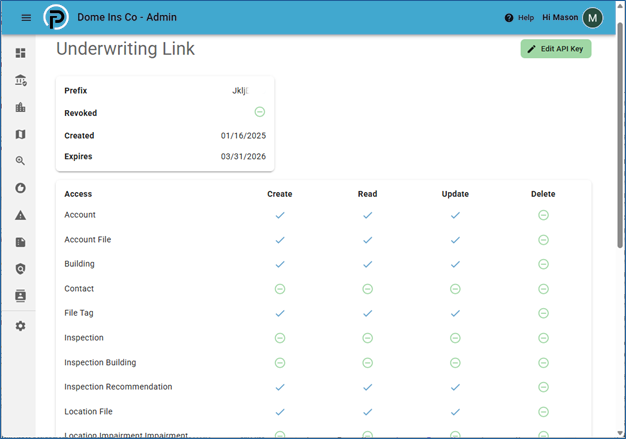

Panarisk’s REST API with token-based authentication allows insurers, brokers, and loss control vendors to seamlessly integrate risk data, underwriting insights, and report automation into their existing systems. Designed for scalability, security, and efficiency, our API ensures that risk professionals have real-time access to critical data, improving decision-making and streamlining operations.

SECURE & RELIABLE

Token-based authentication ensures enhanced security, protecting sensitive underwriting and risk assessment data.

REAL-TIME DATA ACCESS

Sync inspections, reports, recommendations, and risk scoring directly into your underwriting or risk management system.

SEAMLESS INTEGRATION

Connect with policy administration systems, claims management platforms, and third-party analytics tools to enhance operational efficiency.

CUSTOMIZABLE & SCALABLE

Tailor API calls to fit your unique risk assessment process and scale as your business grows.

Panarisk API Use Cases

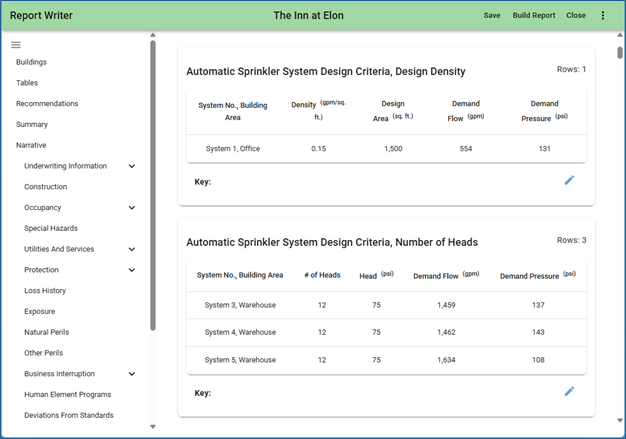

Panarisk’s powerful API transforms how insurers, brokers, and risk managers access and utilize critical risk data. By seamlessly integrating with underwriting platforms, claims systems, and compliance tools, Panarisk streamlines workflows, enhances decision-making, and improves collaboration across the insurance ecosystem. Whether it's accelerating underwriting decisions, synchronizing risk data, or automating compliance reporting, Panarisk ensures your organization operates with greater efficiency, accuracy, and transparency.

AUTOMATED UNDERWRITING DECISIONS

Instantly pull risk scoring, site inspection data, and recommendation statuses into underwriting platforms to accelerate policy decisions.

RISK DATA SYNCHRONIZATION

Ensure loss control reports, impairments, and engineering summaries are always up to date across all systems, reducing duplicate data entry and errors.

CLAIMS & LOSS CONTROL ANALYSIS

Enhance claims management by integrating historical inspection data and risk profiles into claims evaluation tools.

BROKER & CARRIER COLLABORATION

Enable real-time data sharing between brokers, MGAs, and carriers to improve transparency and speed up the underwriting process.

Underwriting & Decision Support

Underwriting and decision support provides insurers and brokers with the data-driven insights needed to assess risk accurately and make informed decisions. By leveraging real-time analytics, risk scoring, and account summaries, underwriters can streamline evaluations, improve pricing strategies, and enhance portfolio profitability. Seamless integration with reporting tools and APIs ensures a smooth underwriting process, reducing manual effort while increasing efficiency and consistency.

RISK SCORING & BENCHMARKING

Assign risk scores based on data analytics, historical trends, and industry benchmarks.

SEAMLESS API ACCESS

Integrate risk assessment data with underwriting platforms, policy issuance systems, and external analytics tools.

Compliance with Panarisk's REST API

Panarisk’s REST API empowers organizations to maintain compliance and audit readiness by seamlessly integrating risk management data into their existing systems. Our API automates data retrieval, ensuring real-time access to inspection records, underwriting decisions, and compliance reports. With structured audit trails, instant status alerts, and customizable reporting capabilities, Panarisk streamlines regulatory adherence while reducing manual effort. By leveraging our API, organizations can enhance transparency, minimize liability, and ensure that critical risk data remains accurate, up-to-date, and readily available for audits.

REAL TIME STATUS ALERTS

Trigger automated alerts and dashboards to track compliance status, impairments, and required actions.

SEEMLESS DATA SYNCHRONIZATION

Ensure audit documentation remains consistent across all platforms, eliminating redundant data entry and errors.