Account Engineer Summary

Our dynamic Account Engineer Summaries provide a comprehensive, data-driven overview of each account, helping underwriters and risk professionals make informed decisions. With detailed site assessments, COPE data, inspection histories, and risk scoring, this summary delivers a clear snapshot of exposures and protection measures. The system automates risk recommendations and follow-ups, ensuring that all mitigation efforts are tracked efficiently. Customizable reporting templates allow for tailored outputs that align with underwriting and compliance requirements, while seamless collaboration tools enable teams to review and refine reports in real time. By centralizing critical risk data, the Account Engineer Summary enhances decision-making, transparency, and underwriting efficiency.

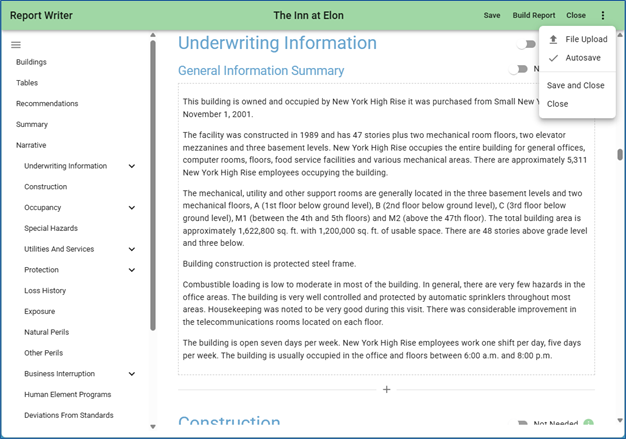

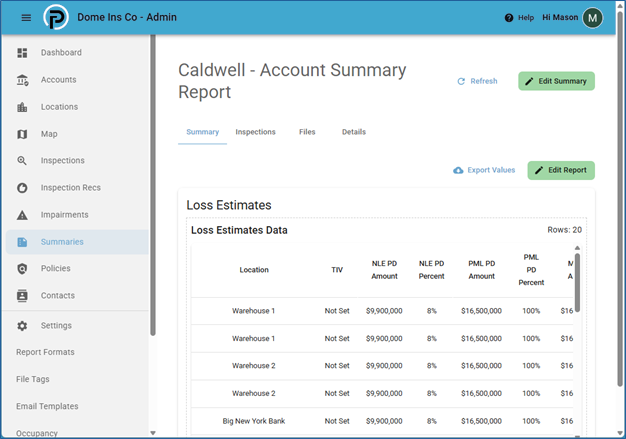

CUSTOMIZABLE RISK REPORTS

Generate customizable comprehensive risk reports that provide a clear overview of exposures, protection measures, and potential loss estimates.

CLEAR INSIGHTS

Provide a clear snapshot of risk factors, COPE (Construction, Occupancy, Protection, Exposure) details, and recommendations.

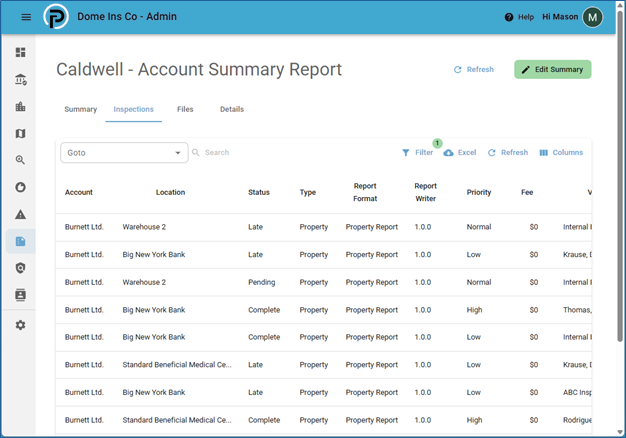

Advanced Inspection & Data Collection

Panarisk’s inspection and data collection tools provide a structured, automated approach to risk evaluation. By integrating real-time site assessments, standardized reporting, and digital checklists, inspectors can efficiently document key risk factors such as COPE data and structural conditions. The system’s smart workflows ensure that findings are instantly transferred to underwriting platforms, eliminating manual entry and reducing discrepancies. With automated risk scoring and recommendation tracking, users gain actionable insights to improve decision-making and prioritize loss mitigation efforts. Designed to enhance operational efficiency, Panarisk’s platform ensures greater accuracy, compliance, and collaboration across carriers, brokers, and risk management teams.

REAL TIME DATA

Capture real-time data from on-site inspections and integrate findings directly into reports.

CHECKLISTS

Utilize pre-built checklists and risk assessment frameworks for consistency and accuracy.

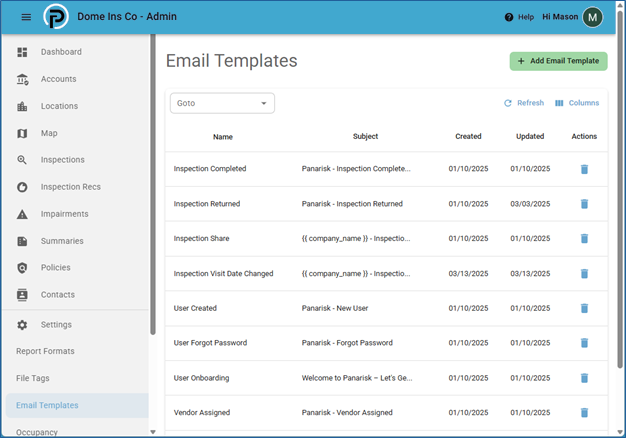

Seamless Collaboration & Review Process

Panarisk’s Seamless Collaboration & Review Process enhances efficiency by allowing underwriters, brokers, and risk engineers to work together in real time. With centralized report access, version control, and commenting tools, teams can easily review, refine, and finalize risk assessments without duplicating efforts. Automated notifications ensure that stakeholders stay informed of updates, while built-in audit trails track all changes for compliance and accountability. By streamlining communication and reducing manual back-and-forth, Panarisk helps organizations make faster, more informed risk decisions, improving both workflow efficiency and underwriting accuracy.

COLLABORATE

Enable underwriters, brokers, and loss control teams to review, comment, and refine reports collaboratively.

VERSION CONTROL

Maintain version control and track changes with a built-in audit trail.

Audit ReadyCompliance & Data Integrity

Panarisk ensures compliance and data integrity by maintaining a secure, audit-ready system that tracks every aspect of the risk management process. With automated documentation, detailed audit trails, and regulatory-aligned reporting, organizations can confidently meet industry standards while reducing liability. Built-in validation checks help maintain data accuracy and consistency, ensuring that all risk assessments, underwriting decisions, and recommendations are properly recorded. Role-based access controls further enhance data security, allowing only authorized users to modify or approve critical information. By centralizing compliance efforts, Panarisk helps businesses streamline audits, mitigate risks, and maintain complete transparency in their operations.

AUTOMATIC DOCUMENTATION

Capture and store all risk assessments, underwriting decisions, and recommendations in a secure, audit-ready system.

DETAILED AUDIT TRAILS

Maintain a comprehensive record of all user actions, data modifications, and compliance activities for full transparency.