End-to-End Risk Management

By integrating inspections, report writing, recommendation tracking, and decision-making with Panarisk, organizations can eliminate bottlenecks, reduce manual errors, and enhance collaboration between risk engineers, underwriters, and brokers. Real-time data access and automated alerts enable proactive risk mitigation, leading to faster decision-making and improved portfolio performance.

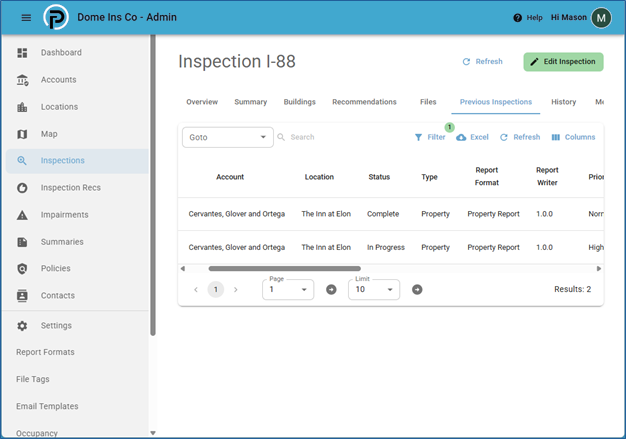

DATA COLLECTION & SITE ASSESSMENTS

Capture and centralize critical risk data across multiple insurance lines, including property, fleet, workers’ compensation, general liability, product liability, and cyber security. Standardized reporting and seamless integration ensure real-time access for underwriting, claims evaluation, and risk management decisions.

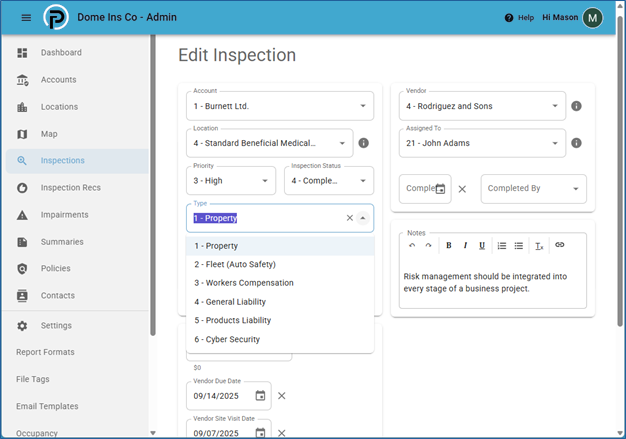

CUSTOMIZABLE WORKFLOWS

Adapt the workflow to match underwriting, loss control, or client-specific reporting needs. Whether you're creating detailed risk reports for underwriting, conducting safety assessments for loss control, or generating any other type of specialized report, you have the freedom to configure each workflow to best suit your team’s needs.

Recommendations & Follow Ups

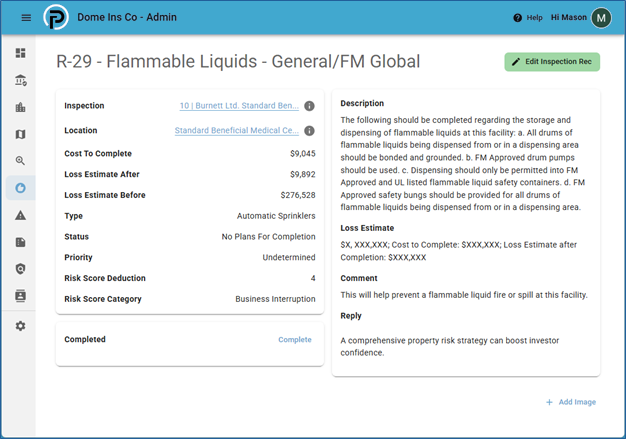

Effective risk recommendations and recommendation follow-ups ensure that identified hazards are addressed promptly, reducing potential losses and improving overall risk profiles. By automating recommendation tracking, prioritizing actions based on severity, and sending timely alerts, organizations can proactively mitigate risks. A structured follow-up process ensures compliance, enhances underwriting confidence, and strengthens client relationships by demonstrating a commitment to risk improvement.

AUTOMATED RECOMMENDATION TRACKING

Monitor open risk recommendations and categorize them by priority, status, and estimated loss impact. Track site details, occupancy insights, employee safety metrics, vehicle telematics, regulatory compliance factors, supply chain vulnerabilities, and historical claims data.

STATUS ALERTS & NOTIFICATIONS

Ensure timely action on pending risk mitigations with automated alerts for overdue tasks. Panarisk's customizable workflows and dashboards give you the ability to design and modify processes that align perfectly with your business objectives.

Compliance & Audit Readiness

Panarisk simplifies compliance and audit readiness by providing a centralized platform that focuses on every aspect of risk management, from inspections to underwriting decisions. With automated documentation, detailed audit trails, and customizable reporting, users can easily demonstrate compliance with regulatory standards and industry best practices.

COMPREHENSIVE AUDIT TRAILS

Maintain a detailed history of inspections, reports, recommendations, and user actions for compliance reviews. Generate dashboards and reports tailored to regulatory requirements (NFPA or FM Global), underwriting guidelines, or broker standards.

TRANSPARENT & RELIABLE RISK DATA

Panarisk ensures transparency, reduces liability, and streamlines audit preparation, giving organizations confidence that their risk data is accurate, up-to-date, and readily accessible when needed.